louisiana inheritance tax waiver

Retirees get a 6000 annual exemption on these sources of. The tax begins when the combined transfer exceeds the unified exemption.

Will I Have To Pay Taxes On My Inheritance Sessions Fishman Nathan L L C

The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to the beneficiaries.

. No inheritance tax receipts will be issued for deaths that occurred after June 30 2004 unless an inheritance and estate transfer tax return was filed with LDR before January 1 2008. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. An inheritance tax form that oklahoma inheritance tax waiver.

There chance though that. Asked Rabih Bellow Last Updated 9th February 2022 Category personal finance personal taxes 47 181 Views Votes Missouri also does not have inheritance tax. The Louisiana inheritance tax return.

Its usually issued by a state tax authority. This leaves the widow or widower upset and concerned that. Estates with Louisiana property that is worth over 125000 will likely have to.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release. The failure to plan. In order to make sure.

The federal estate tax exemption is currently over 11. In the absence of a federal extension a Louisiana extension may be granted for a period not to exceed 15 months from date of death if it is determined. For a husband and wife who are living under a community propertys regime that means their joint estate has to be in excess of 22 million dollars for there to be an estate tax imposed.

In 2018 that exemption was fixed at 11 million dollars for an individual and 22 million dollars for a. In louisiana the assets of a person who died without leaving a will are distributed to surviving descendants as follows. 1 Inheritance tax due From Line 7 Schedule IV 2 Estate transfer tax From Line 8 Schedule IV 3 Interest due on inheritance and estate transfer taxes See instructions 4 Total amount due.

Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO. Not only is a tax waiver not needed but the Inheritance Tax Bureau will not issue a tax waiver when there is a surviving spouse. The exemption is 117.

It partially taxes income from private pensions and withdrawals from retirement accounts like 401k plans. What is an Inheritance or Estate Tax Waiver Form 0-1. State of Louisiana Department of Revenue PO.

No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Louisiana Administrative Code 61III2101B provides that before a request for waiver of penalties can be considered the taxpayer must be current in filing all tax returns and all.

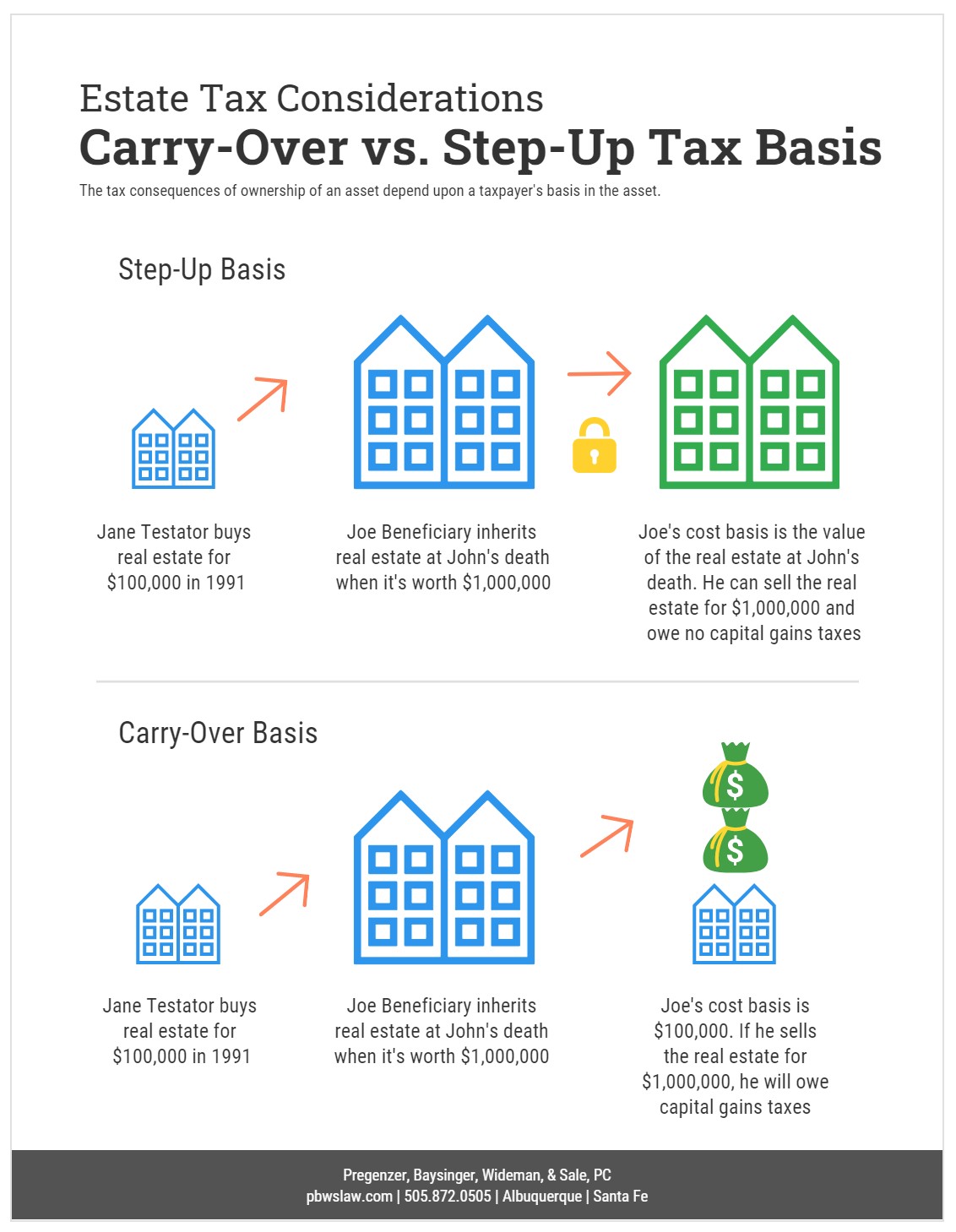

Only after this are heirs entitled to their portion of the estate according to Louisiana inheritance laws. The tax begins when the combined transfer exceeds the unified exemption. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate.

Does Louisiana impose an inheritance tax. Louisiana Inheritance Tax Waiver Form. Effective January 1 2012 no receipts will.

Will I Have To Pay Taxes On My Inheritance Sessions Fishman Nathan L L C

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Estate Tax Waiver Notice Et 99 Pdf Fpdf Docx New York

Forms Louisiana Department Of Revenue

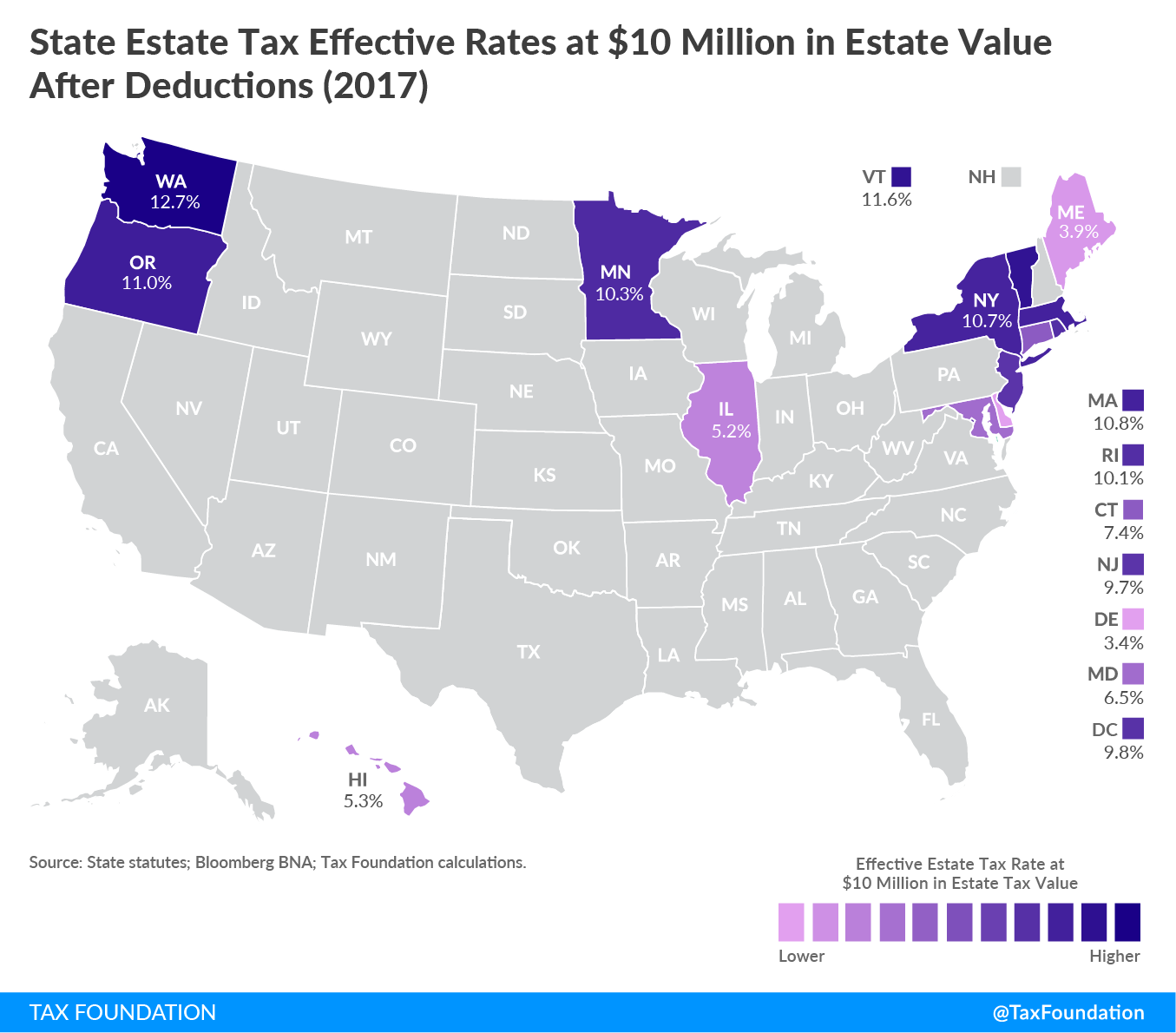

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Louisiana Estate Tax Everything You Need To Know Smartasset

Estate Taxes Under Biden Administration May See Changes

Estate Planning Louisiana Law Blog

Historical Louisiana Tax Policy Information Ballotpedia

Rev 1500 Fill Out Sign Online Dochub

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Estate Tax Everything You Need To Know Smartasset

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

State Estate And Inheritance Taxes Itep

State Death Tax Hikes Loom Where Not To Die In 2021

Louisiana Estate Tax Planning Vicknair Law Firm

New Federal Estate Tax And Gift Tax Legislation Louisiana Law Blog